Contents:

Get a snapshot of your monthly profit and loss report by entering your financial data and selecting the month that you want to view in the dashboard. While there are many accounting uses for Excel, we don’t recommend using it as your primary bookkeeping software to track your cash flow and classify your income and expenses. While it can be done, it’s much simpler to use one of the many free accounting software that are available in both cloud and desktop formats. The excel cash book template tracks your daily and monthly transactions to control your profits or loss.

Come tax season, your accountant will need your income sheets for the year. When you use Bench, your transactions are automatically imported and categorized for you. But for DIY bookkeeping in Excel, you’ll be doing it yourself.

Business Expenses – 2 Excel Accounting Templates

The income and expenses descriptions can be changed to suit the business. For example, Excel has an inbuilt profit and loss statement template, business expenses budget template, budget planner template, and more. With our easy-to-use Accounting Template, you can consolidate all the accounting information and workflows in your business to manage everything on a single dashboard. This empowers you with a bird’s-eye view of all your finances.

If you’re self-employed, include home office expenses and other deductibles to help save time during tax season. The template keeps a running subtotal of expenses, adjusting the total sum with each new entry. Basic bookkeeping software makes it easy to maintain detailed and accurate books. Net income from the income statement increases equity in the balance sheet. This is a big source of confusion for small business owners, so you may get help from an accountant if you’re using Excel.

Replace all the information in the how to make an invoice with actual vendors, then go to the BillData sheet. Eric is a staff writer at Fit Small Business and CPA focusing on accounting content. He spends most of his time researching and studying to give the best answer to everyone.

What is a debit in accounting?

It also breaks down your revenue and expenses in detail, so you know exactly how you make and how you spend. For business owners, knowing whether a business is making profits or not is vital for growing the business. Thus, the way to do this is to create a profit & loss statement, which can use to generate your monthly financial report. As a landlord, tracking your monthly rental income and expenses is an essential part of effectively managing your rental property and getting the most out of your investment.

Acquire MS Office Skills with the 11 Best Paid & Free Online … – Fordham Ram

Acquire MS Office Skills with the 11 Best Paid & Free Online ….

Posted: Wed, 08 Feb 2023 08:00:00 GMT [source]

Ask your accountant to verify that you’ve added net income to the equity account correctly. Allows you to practice entering the details of a business transaction in the top half and watch as the bookkeeping journal unfolds in the second half. It can be used for income and expenses paid into or out of a bank account, petty cash, credit card etc. This trial balance worksheet compares beginning and ending balances on each of your financial accounts based on debit and credit transactions over a given period.

If you find these free excel accounting templates, please share with friends

Using Excel for bank reconciliation becomes challenging and inefficient if you have a high volume of transactions. However, it’s a fantastic tool to supplement your bookkeeping system by performing needed reconciliations and calculations. We discuss how you can use Excel to enhance your accounting and fill in the gaps left by many free software and provide templates to assist you.

And a large number of data entries may increase the risk of error. It’s important to note the cash general ledger page only lists the cash portion of each journal entry. Journal entry No. 1 only lists the $10,000 reduction in cash.

That’s why you need these accounting templates to keep your business finance history in one place. A company’s general ledger is a record of every transaction it posts throughout its lifetime, including all journal entries. Business owners and accounting professionals use the data in the general ledger to create financial statements. Learn how to post accounting transactions and create financial statements using Excel spreadsheets. Read about the benefits of converting to accounting software. The excel cash book is the simplest and easiest way to start recording and tracking your business income and expenses and bank balance, for your day to day bank accounts.

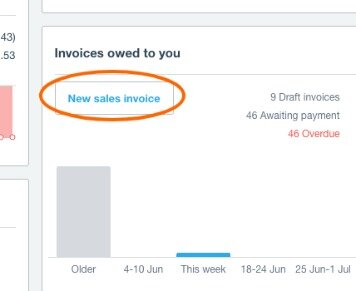

The totals page will show if the business has made a profit or loss for the year, by showing all the income and expenses. TheAccounts Receivablestatement template allows you to list all your sales invoices issued to customers. It will calculate when an invoice is due and how many days are overdue. If you’re focusing less on overall accounting and more on your financial statements, our Financial Statements Template will fit the bill. If you’re on the hunt for the perfect Excel accounting template but can’t find any Microsoft templates that fit the bill, you should check out monday.com’s free Excel accounting template. Let’s talk about the different types of accounting templates.

- General ledgers provide the date, journal entry, and the entry description, along with the debit or credit amount and the ending balance.

- Use formulas to ensure that total debits equal total credits.

- In order to generate monthly Income Statements, you’ll need separate sheets for each month.

- When you produce the income statement, net income subtracts total expenses from total revenue.

- You may want to make a copy of each one at the end of the month, and either save it or upload it to the cloud.

Expense designates any account used to track money leaving your business. Income designates any account used to track money coming into your business. The Chart of Accounts includes an account for “Gas & Auto.” But if you don’t drive for work, you don’t need this row—so you can delete it.

Cash Flow Forecast Template

Stay on top of your https://bookkeeping-reviews.com/ with this easy-to-use worksheet that you can personalize to meet the needs of your rental business. Smartsheet provides a better way to unify collaboration and automate workflows so you can spend more time on the work that matters. Relevant resources to help start, run, and grow your business. The tools and resources you need to take your business to the next level. The tools and resources you need to run your business successfully.

And bookkeeping in Excel can lead to errors and inefficiency. Having an Excel accounting template to fall back on gives you some peace of mind in knowing you’re on the right track. A template will guide you in terms of all the fields and columns you have to include and what financial data you’ve got to keep tabs on. While using Excel for accounting tasks can be beneficial and inexpensive, it can also be a time-consuming process with the potential for errors. Check out our list of the best small business accounting software for guidance. The profit & loss statement shows your revenue/income and expenses and tells you how profitable your business has been over a designated period.

There are a number of free accounting templates for Excel and Google Sheets you can download and import onto your desktop or web app. The process of tracking how much money is owed to vendors, when the bills are due, and when they have been paid is known as A/P. If you aren’t diligent with paying your vendors on time, you can end up with bad credit and a lack of supplies, among other things.